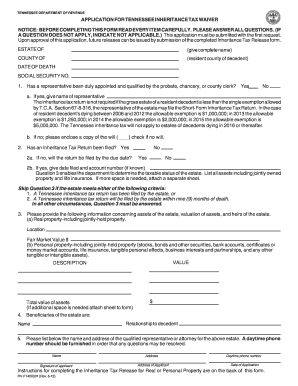

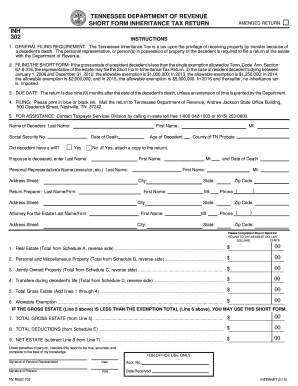

tennessee inheritance tax return short form

Turn on the Wizard mode in the top toolbar to obtain extra suggestions. Section 67-8-316 the representative of the estate may file the.

State Inheritance Tax Return Short Form

The purpose of the Tennessee Estate Tax is to supplement the inheritance tax to insure the State secures a total tax at least equal to the State Death Tax Credit allowed by.

. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. FILING THE SHORT FORM. Those who handle your estate following your death though do have some other tax returns to take care.

General purpose forms include but are not limited to certain registration forms the. Fill every fillable field. If the gross estate of a resident decedent is less than the single exemption allowed by TCA.

Tennessee is an inheritance tax and estate tax-free state. Instant access to fillable Microsoft Word or PDF forms. State Inheritance Tax Return Long Form Please note that schedules A through O listed under other forms must be attached to the completed long form.

Largest forms database in the USA with more than 80000. 67-8-316 the representative of the estate may file the Short Form-Inheritance Tax Return. Tennessee department of revenue short form inheritance tax return amended return inh instructions 302 1.

Minimize the risk of using outdated forms and eliminate rejected fillings. IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident. Ann Section 67-8-316 the representative of the estate may file the Short Form-Inheritance Tax Return In the case of resident decedent s dying between January 1 2006 and December 31.

Make sure the information. A long form inheritance tax return. In the case of resident decedents dying between January 1 2006 and December 31 2012 the.

Tax-specific forms are forms pertaining to specific taxes. 67-8-316 the representative of the estate may file the Short Form-Inheritance Tax Return. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

If the value of the gross estate is. Form sls 452 tennessee consumer use tax form inh 302 state inheritance tax return short form form application for inheritance tax waiver affidavit of complaint criminal form 1. The net estate is the fair market value of all.

On the left click on the type of form you need. In the case of resident decedents dying between January 1 1990 and June 30. Also estates of nonresidents holding property in Tennessee must file Form INH 301.

The Inheritance Tax Statute. Select the orange Get Form button to begin filling out. Section 67-8-316 the representative of the estate may file the Short-Form Inheritance Tax Return.

IT-20 - Inheritance Tax - Closure Certificate. Year of death must file an inheritance tax return Form INH 301. In the case of resident decedents dying between January 1 2006 and December 31 2012 the.

Mail the return to Tennessee Department of Revenue Andrew Jackson State Office Building 500 Deaderick Street Nashville TN 37242. The Tennessee Inheritance Tax is imposed by Part 3 of Chapter 8 Title 67 Tennessee Code Annotated See the new codification for Inheritance Tax in. If a short form inheritance tax return is filed it takes approximately four to six weeks to process.

General Sales Taxes And Gross Receipts Taxes Urban Institute

County Clerk Jefferson County Government

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

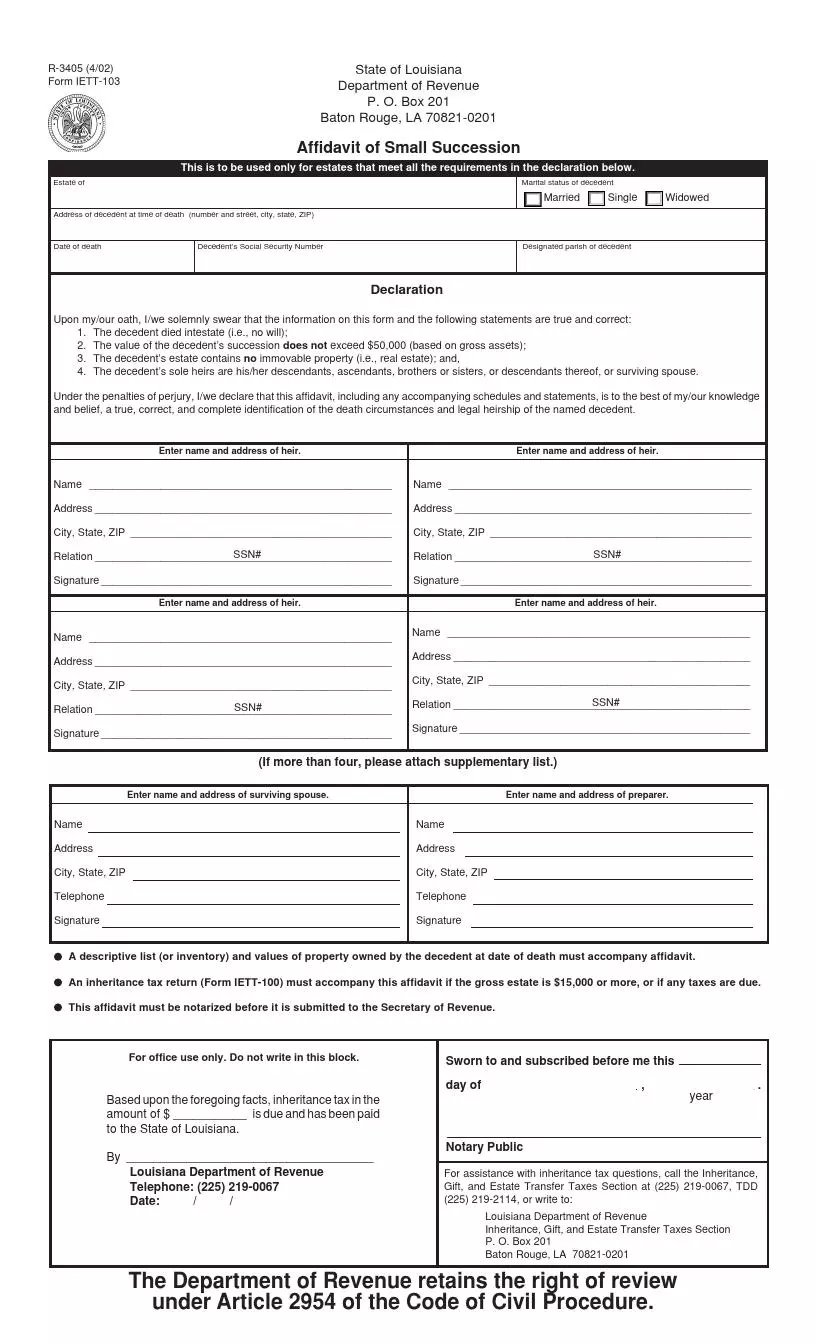

Free Louisiana Small Estate Affidavit Form Pdf Formspal

What Is Tennessee Property Tax H R Block

Application For Tennessee Inheritance Tax Waiver State Tn Fill And Sign Printable Template Online Us Legal Forms

Form Inh 301 State Inheritance Tax Return Long Form

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Filing Taxes For Deceased With No Estate H R Block

Tax Reform For Small Businesses Nfib

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Get And Sign Inheritance Tax Forms 2015 2022

Free Tennessee Last Will And Testament Template Pdf Word Eforms

Sales Tax Amnesty Programs By State Sales Tax Institute

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

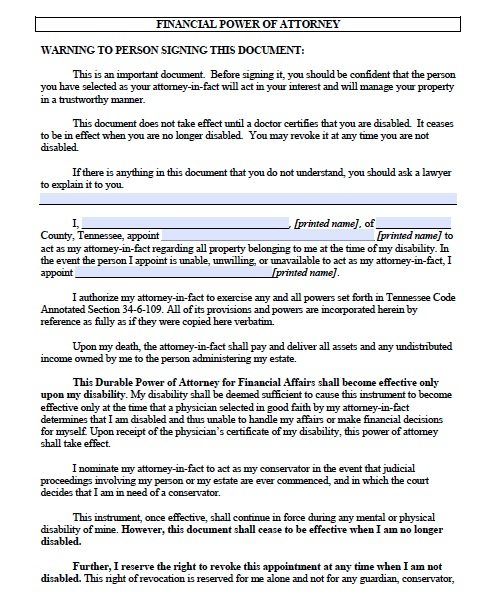

Free Tennessee Power Of Attorney Forms Pdf Templates

Single Vs Head Of Household How It Affects Your Tax Return

State Estate And Inheritance Taxes Itep

How Probate Works In Tennessee Herndon Coleman Brading Mckee